AMS has an enviable client base in the New Zealand life insurance market. However, the importance of that market and the role we play in it, is not that clear. We are often asked ‘how and why?’ we’re involved in the industry – including by those who work within it. In an effort to keep the complex, simple – here is our overview of one of the most important industries in most people’s lives and our role in it. Starting with what makes Life Insurance in New Zealand, unique.

AMS and the Life Insurance Market in New Zealand

26 Jul, 2021

Life Insurance in NZ

There are many variations of Life Insurance and Living Insurance products available in New Zealand. Insurance companies create products and benefits which are sold separately or bundle the insurances into their own insurance products. These are commonly grouped as Life Insurance, Living Insurance and Critical Illness. However, these traditional product offerings fall within a relatively unique eco-system.

The New Zealand Life Insurance industry works within an environment which includes Accident Compensation Corporation (ACC), KiwiSaver and NZ Superannuation (NZ Super) – all of which provide a type of Insurance for New Zealand citizens and residents.

Accident Compensation Corporation (ACC)

ACC provides cover in the event of an accidental injury or death. The ACC scheme provides for personnel expenses, including medical expenses and partial replacement of lost income because of a person’s injury, and a survivor’s benefit for fatal accidents. As ACC is a publicly funded scheme, there is no compulsory insurance often seen in other markets such as motor insurance and workers compensation insurance. This has led to a tendency for New Zealanders to regard ACC as adequate for disability cover and there is a lack of awareness that incapacity due to illness, which is statistically more likely, is excluded.

KiwiSaver

Back in 2007 the NZ Government introduced KiwiSaver. This is a voluntary retirement savings scheme with contributions made from a person’s salary or wages. NZ Government also contribute to KiwiSaver as part of the scheme. This would not apply for private sector savings-type products.

The simplicity of process and participation of NZ Government has led to a preference for Kiwis to invest directly in KiwiSaver as a vehicle for retirement savings, rather than seeking alternative savings / investment type products.

NZ Super

NZ Super provides universal superannuation for people over the age of 65. NZ Super reduces the exposure to financial hardship at older ages.

With the availability of support through ACC, KiwiSaver and NZ Super, coupled with a strong public health care system, there is some complacency around life insurance observed in New Zealand not seen in other countries. There is the belief that financial support in times of life-changing events will be provided by the Government. According to recent research by the Financial Service Council, this has resulted in a degree of underinsurance which follows a global trend but is impacted by a unique culture around insurance, in New Zealand.

Common Life Insurance Types

There are, however, a number of life-changing events which typically trigger the average New Zealander to at least consider life insurance. Not the least of these is the purchase of a property where holding insurance cover to the value of the mortgage can be a requirement. This has given rise to a ‘bankassurance’ industry that AMS also significantly supports.

While the purchase of mortgage insurance can be a relatively straight forward consideration there are many different flavours of insurance available to the New Zealand buyer. These relate to both insuring your ‘life’ and covering assets and liabilities should a traumatic event occur. The main offerings include:

| Term life insurance | Pays the insured amount only if death or terminal illness occurs within the period set out in the policy. The insured amount may be level for the period or increase or decrease on specified terms (e.g., increase with the CPI or decrease in line with the increased risk of death a level premium will purchase). |

| Endowment insurance | Pays the sum insured during the period of the policy or if the insured person survives to a specified age (often 60 or 65). As the sum insured will be paid at some stage, the policy has a value if it is cancelled that increases the longer the policy is in force. For some policies, the insured amount increases with bonuses declared by the insurance company. |

| Whole of life | Pays the sum insured whenever death occurs. As the sum insured will be paid at some stage, the policy has a value if it is cancelled that increases the longer the policy is in force. For some policies, the insured amount increases with bonuses declared by the insurance company. |

| Guaranteed acceptance | Pays the sum insured on death. This type of cover is accepted based on the answers to a small number of high-level risk assessment questions. |

| Accidental death | Pays the sum insured, only when death occurs resulting from an accident. This type of cover usually sold, when the customer is unable to obtain full cover, due to pre-existing conditions. Low-cost cover, due to the reduced likelihood of death being the result of an accident. |

| Credit Insurance | Pays your Credit Card or Loan payments, in the event of loss of income due to redundancy, illness or accident. May also pay a lump sum to the value of the amount outstanding, because of death. |

Common Living Insurance Types

| Critical illness – also known as 'trauma' | Pays a lump sum when the individual suffers from one of several medical conditions listed in the policy (e.g., cancer, stroke, heart attack). |

| Total and permanent disability (TPD) | Pays a lump sum if your disablement is total and permanent and you are unlikely to be able to do your usual or similar work again. |

| Disability income | Pays a regular income to replace your usual income when you cannot work because of sickness or disability. Usually, a maximum of 75% of pre-disability income is paid. You can choose a ‘waiting period’ until the insurance is paid and a maximum payment period (e.g. two years or up to age 65) that will affect the premium you pay. |

| Home loan insurance | Pays your mortgage or mortgage repayments if you die or are ill or disabled. |

| Credit insurance | Pays your Credit Card or Loan payments, in the event of loss of income due to redundancy, illness or accident. May also pay a lump sum to the value of the amount outstanding, because of death. |

| Replacement income | Disability income. |

Life Insurance Snapshot

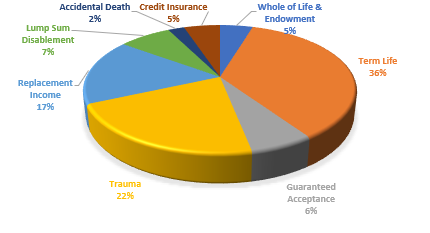

Despite general ‘underinsurance’ by New Zealanders, the New Zealand life insurance industry is a quiet achiever. In September 2020, the Financial Services Council reported our Life Insurance companies collected $2.75 Billion in insurance premiums for the preceding 12 months and paid out $1.4 Billion in claims. The spread of premiums collected is grouped across the following benefit types:

AMS provides the solution to managing NZ Life Insurance

AMS Insurance Management has an important role to play for key players in the New Zealand life insurance market. Behind the scenes our solution supports the management of all the contemporary Life Insurance product and benefit types, including modular products, which can be mixed and matched to meet the current and changing needs of customers.

Life insurance policies, quite literally last a lifetime, and the AMS Insurance solution is designed to support their management for the long-term. It provides peace of mind to those issuing the policies that you are meeting your legal commitments while making it as easy as possible for customers to keep policy details updated. It also requires a highly secure and compliant data environment to meet the demands of what is an equally highly regulated industry.

Because AMS has been providing an insurance management platform for over 30 years, you can have confidence in our ability to support legacy product as well. We currently manage policies across a number of historic offerings, including but not limited to, Endowment, Bonus Endowment and Whole of Life products. This also includes investment products from Bonds to Unit Linked and Capital Accumulated products.

It is an undeniably complex environment with highly specialised technology and workflows to support what is a life-critical industry. We are extremely proud of the role we have to play in managing it. If you would like to learn more about the AMS Insurance Management solution – please get in contact.